MSRB Announces Results of Qualifying Examination for Municipal Advisors

More than 3,000 individuals at 505 municipal advisor firms across the country are now qualified to provide advisory services to state and local governments and other clients following implementation of the first mandatory qualifying examination for municipal advisor professionals, the Municipal Securities Rulemaking Board (MSRB) announced.

Effective September 12, 2017, the MSRB’s Series 50 exam is a required baseline test of competency for professionals who provide advice on the issuance of municipal securities or use of municipal financial products. The MSRB developed the Series 50 as part of its comprehensive regulatory framework for municipal advisors in support of its mission to protect municipal securities issuers and other market participants. All MSRB professional qualification exams, including the Series 50, are developed in accordance with the national standards for educational and psychological testing, which involves extensive outreach to gather input from industry professionals about the appropriate content for the exam. Municipal advisors could first take the Series 50 in September 2016, following an initial pilot qualifying period earlier that year, and had a one year grace period to take and pass the exam while continuing to engage in municipal advisory business.Throughout this grace period the MSRB provided resources and assistance to firms and individuals preparing to take the exam, including educational webinars and answers to frequently asked questions. As the deadline for the exam approached the MSRB monitored municipal advisor firms’ progress toward enrolling their associated persons to take the exam and provided additional information through emails and phone calls.

“The MSRB made it a priority to communicate with the municipal advisor community and provide helpful information about the requirements, timeline and process for taking the Series 50 exam,” Kelly said. “This is a diverse industry with firms ranging in size from single-person shops to major institutions that provide both broker-dealer and municipal advisory services. It was important to the MSRB that all firms, regardless of size, business model or location, understood what they needed to do and when. ”Of the 505 firms that have Series 50-qualified municipal advisor representatives, 184 were sole practitioners as of September 19, 2017. About a quarter of the firms are dually registered as both broker-dealers and municipal advisors, while the majority are independent non-dealer municipal advisors. Of the municipal advisor firms with no qualified Series 50 representative, approximately 50 firms have professionals scheduled to take the exam. Another 40 firms registered with the MSRB to provide municipal advisory services have determined not become qualified because they are not engaging in the business.

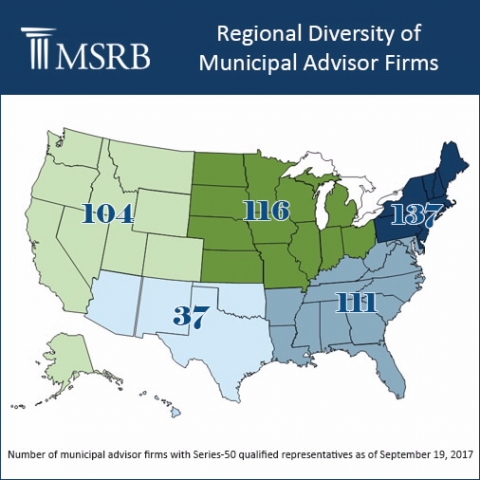

There are firms in each region of the country, with the northeast region having the highest concentration of firms at 137.

After September 12, 2017, no individual can engage in municipal advisory business without first earning the Series 50 qualification. The MSRB continues to educate municipal bond issuers about the importance of verifying the registration and qualification status of their municipal advisor firms by checking the MSRB’s website.

View a list of MSRB-registered municipal advisor firms with the names of their Series 50-qualified representatives.