Get Ready! New SEC Disclosure Rules are Coming

October 5, 2022 – Articles

The SEC’s final rule for its pay versus performance disclosure will require registrants to disclose information reflecting the relationship between executive compensation actually paid by a registrant and the registrant’s financial performance. The rules implement the Dodd-Frank Act’s pay versus performance disclosure mandate. In adopting the rules, the SEC sought to make “it easier for shareholders to assess a public company’s decision-making with respect to its executive compensation policies” while also providing “for new, more flexible disclosures that allow companies to describe the performance measures it deems most important when determining what it pays executives.” In turn, the hope is that the new disclosures will better provide investors with “consistent, comparable, and decision-useful information” to evaluate executive compensation policies.

Effective Date

The final rules will become effective 30 days following publication of the rules in the Federal Register. Impacted companies must begin to include the disclosure in any proxy or information statement covering a fiscal year ending on or after December 16, 2022.

Impacted Companies

Requirements apply to all publicly traded companies, except:

- emerging growth companies,

- foreign private issuers, and

- registered investment companies.

Smaller reporting companies (“SRCs”) are subject to the rule, but are allowed to provide scaled disclosure.

At the end of this article, we outline steps you can take to ensure compliance that will require significant planning and preparation.

Required Disclosures

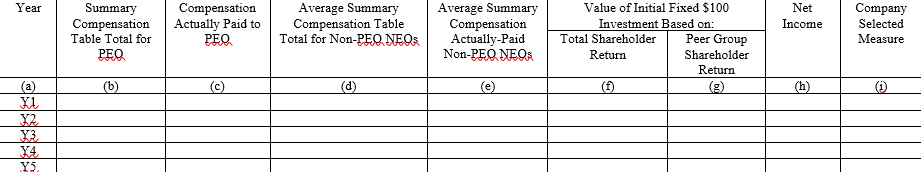

Tabular disclosure

Covered years

The tabular disclosure is required to present compensation and performance information for the company’s last five fiscal years. There is transition relief available to new reporting companies until they have fully phased into the five-year requirement.

Summary Compensation Table for Total PEO

This field captures the total compensation for the company’s principal executive officer (“PEO”). It is the same amount that is reported in the Summary Compensation Table (“SCT”) for the applicable fiscal year. For any year in which the issuer had multiple PEOs, the table should include additional columns for each PEO. Additionally, if there is more than one PEO, the issuer should use footnotes to identify the names of the PEOs referenced in the table.

Compensation Actually Paid to PEO

To calculate this field, the SCT Total amount is adjusted for each fiscal applicable year in the table to reflect changes in the value of equity awards and pension benefits.

- Equity Awards: These values are adjusted by subtracting the amounts reported in the SCT for equity awards and then adding the value of any dividends or other earnings paid on equity awards in the applicable fiscal year prior to the vesting date.[1]

- Pension Values: These values are adjusted by, (i) subtracting from the SCT total the aggregate change in the actuarial present value of all defined benefit and actuarial pension plans, and (ii) adding back the sum of the service cost[2] and the prior service cost.[3]

Average Summary Compensation Table Total for Non-PEO NEOs

This field discloses the average total compensation for the company’s named executive officers, other than its PEO, (the “Non-PEO NEOs”) as reported in the SCT for the applicable fiscal year. Footnotes should be used to identify the name of each individual included in the Non-PEO NEOs in the table.

Average Compensation Actually Paid to Non-PEO NEOs

This field captures the average total compensation actually paid to the company’s Non-PEO NEOs, it is calculated in the same manner that is described above for the issuer’s PEO.

Total Shareholder Return and Peer Group Total Shareholder Return

The company’s total shareholder return (“TSR”), is calculated as the return on a fixed investment of $100 in the company’s stock for the period beginning on the last trading day before the earliest fiscal year in the table through the end of the fiscal year for which the total shareholder return is being calculated. It is calculated on the same cumulative basis as is used in Item 201(e) of Regulation S-K.

Likewise, the TSR for the company’s peer group, reports the return on a fixed investment of $100 in the stock of the peer companies, as applicable, with the returns of the peer companies determined on a weighted basis using their respective market capitalizations at the beginning of the period. The peer group used for this tabular disclosure must be either (i) the peer group used by the company for purposes of Item 201(e) of Regulation S-K or (ii) the peer group used in the company’s CD&A for purposes of disclosing compensation benchmarking practices. If the company changes the peer group it uses in this tabular disclosure from a peer group that was used in a previous fiscal year, it should disclose this change in a footnote.

Company-Selected Measure

The “Company-Selected Measure” is the metric that the company identifies as its most important financial performance measure in aligning compensation “actually paid” to the NEOs with company performance. The rule does not require companies to provide the methodology used to calculate the Company-Selected Measure. Note: The heading of this column should be renamed to identify the metric.

Comparative Disclosure (Graphical, Narrative or a Combination)

To accompany the pay-versus-performance table, the rule also requires a clear description, in narrative and/or graphical form, of (i) the relationship between compensation actually paid to the company’s NEOs as shown in the table and the company’s financial performance measures included in the table, and (ii) the relationship between the company’s TSR and the TSR of its peer group. In addition, if the company elects to provide additional voluntary performance measures in the pay-versus-performance table, it must also include a description of the relationship between executive compensation actually paid and each included performance measure across all covered fiscal years.

Tabular List

Finally, the company is also required to disclose a Tabular List of the three to seven of its “most important” financial performance measures that it uses to link the compensation “actually paid” to executives with company performance. Issuers have three different options for presenting the list, in the form of:

- a single list covering all NEOs;

- two lists, with one covering the PEO and the other covering all of the Non-PEO NEOs; or

- a separate list for the PEO and each Non-PEO NEO.

Steps to Take

Although companies have previously been required to provide a description of the pay-for-performance elements of their compensation structure, the new pay vs. performance rules go much further. The new rules will require significant planning and preparation for all affected companies and there are important steps they can begin taking now:

- Externally:

- Reach out to pension plan administrator and actuary

- Strategize with compensation consultants and corporate governance counsel

- Internally:

- Talk to the chairperson of compensation committee

- Gather the historical data

- Determine the peer group

- Mock-up the disclosure

- Determine which Company-Selected Measure would be the most appropriate to include in the tabular disclosure

- Determine whether graphic and/or narrative disclosure is preferable for the comparative disclosure

- Identify which performance measures are “most important” and should be included in the Tabular List

- Consider where the new disclosure should be located in the proxy statement

- Work on educating team on how to calculate the fair value of stock awards and stock options on an ongoing basis after the grant date, and begin building these recalculations into the end-of-year process, to the extent this is not already done.

If you still have questions about the newly adopted pay vs. performance rules, please reach out to David Lavan or your Dinsmore compliance representative.

* Lindsey Adams is a first-year associate and not yet licensed to practice law

[1] For the awards granted in the covered fiscal year, i) add the year end fair value if the award is outstanding and unvested as of the end of the covered fiscal year; ii) add the fair value as of the vesting date for awards that vested during the covered fiscal year; and ignore any such awards that were forfeited or determined to be ineligible to vest during the covered fiscal year. For the awards granted in prior years, i) add or subtract any change in the fair value as of the end of the covered fiscal year (compared to the end of the prior fiscal year) if the award is outstanding and unvested as of the end of the covered fiscal year; ii) add or subtract any change in fair value as of the vesting date (compared to the end of the prior fiscal year) if the award vested during the covered fiscal year; and iii) subtract the amount equal to the fair value at the end of the prior fiscal year if the award was forfeited during the covered fiscal year.

[2] This is calculated as the actuarial present value of the executive’s benefits under all plans attributable to services rendered during that year.

[3] This is calculated as the entire cost of the executive’s benefits conferred via a plan amendment during the year that is attributable to services rendered in periods prior to the amendment.