Regula Interruptus – Share Repurchase Disclosure Rule Delayed?

June 13, 2023 – Legal Alerts

The SEC has published its final rule for the modernization of share repurchase disclosures. The final rule will require additional details of an issuer’s share repurchase activity. Unlike the previous requirements for share repurchase reporting, the final rule will require daily repurchase data, reported either quarterly or semi-annually, and eliminates the previous requirement for the publication of an issuer’s repurchase data by month in its 10-Qs and 10-Ks. Currently, under Item 703 of Regulation S-K, domestic issuers are required to disclose information about share repurchases in quarterly and annual reports, aggregated on a monthly basis and in tabular format. In addition to the frequency that repurchase information is disclosed, the final rule expands the disclosure requirements that are already in existence for these repurchases. The final rule also adds a requirement for disclosures regarding an issuer’s adoption or termination of certain trading arrangements, required quarterly.

The final rule, which was initially proposed in December 2021, was ultimately adopted on May 3, 2023 following three public comment periods. The final rule will require disclosure of repurchase activity through Item 703 of Regulation S-K, Item 16E of Form 20-F, and Item 14 of Form N-CSR. Issuers that are subject to the reporting requirements of the Exchange Act must, on a quarterly basis, provide daily quantitative repurchase data for purchases made by, or on behalf of, the issuer or any affiliated purchaser of shares or other units of any class of the issuer’s equity securities that is registered pursuant to Section 12 of the Exchange Act.

For domestic registrants, amended Item 601 of Regulation S-K will require this disclosure in a new Exhibit 26 to Forms 10-K and 10-Q. This new quarterly exhibit will be deemed “filed” for purposes of liability under the Exchange Act. The new disclosure requirements also apply to Listed Closed-End Funds, which must provide this disclosure in their annual and semi-annual reports on Form N-CSR, as well as to foreign private issuers, which must provide this disclosure in new Form F-SR. This is due within 45 days after the end of each fiscal quarter.

The Lawsuit

Shortly after publication, the new rule was challenged in a lawsuit. The lawsuit was filed by the U.S. Chamber of Commerce, the Texas Association of Business, and the Longview Chamber of Commerce under the Administrative Procedure Act and the First Amendment. In a statement, the U.S. Chamber Executive Vice President and Chief Policy Officer Neil Bradley claimed the final rule “puts the thumb on the scale to discourage buybacks” despite its intent to provide transparency to share repurchases. Bradley also said “the repurchasing of shares improves returns for savers and investors across the economy.”

Effective Date

The final rule, which will become effective on July 31, 2023, provided that there are no developments in the lawsuit, will require all issuers, other than Foreign Private Issuers and Listed Closed-End Funds, to comply with the first quarterly filing that covers the first full fiscal quarter beginning on or after October 1, 2023. Foreign Private Issuers will have to file the new Form F-SR on the first full fiscal quarter beginning on or after April 1, 2024, with narrative disclosures expected in the first Form 20-F following the first Form F-SR. Listed Closed-End Funds will have to file Form N-CSR with the new requirements for the first six-month period beginning on or after January 1, 2024.

Following the filing of the lawsuit, the impact on compliance with the final rules is uncertain. The U.S. Chamber of Commerce recent record regarding challenges to SEC rulemakings is mixed. The Chamber previously challenged an SEC rule regarding Proxy Voting Advice, which resulted in an April 2023 grant of summary judgment in in favor of the SEC. The Chamber, together with the National Association of Manufacturers, and the Business Roundtable, challenged the conflict minerals disclosure rules with a similar First Amendment argument. This resulted in a final judgment holding that the requirement for issuers to report to the SEC and post on their website that any of their products “have not been found to be ‘DRC conflict free’” violated the First Amendment. Unless the court acts on a petition to modify or set aside the SEC rules in whole or in part, the filing of the lawsuit itself does not stay the implementation of the new SEC rule. At this time, the impact of the lawsuit on the final rules, if any, cannot be stated. As a result, issuers should continue taking necessary steps to put disclosure controls and procedures in place to facilitate compliance with the new rules

Previous Requirements

The previous requirements, which will be revised and expanded by the final rule, currently require disclosure of:

- The total number of shares (or units) purchased, regardless of amount and whether made pursuant to a publicly announced plan or program, by the issuer or any affiliated purchaser during the relevant period, reported on a monthly basis and by class, including footnote disclosure regarding the number of shares purchased other than through a publicly announced plan or program and the nature of the transaction;

- The average price paid per share (or unit);

- The total number of shares (or units) purchased as part of a publicly announced repurchase plan or program; and

- The maximum number (or approximate dollar value) of shares (or units) that may yet be purchased under the plans or programs.

Additional requirements were also present for all publicly announced repurchase plans of programs.

Final Rule Expansion

The information that is discussed below is the impact of the final rule as currently drafted. This is based on an assumption that the final rule with survive its challenge in the lawsuit.

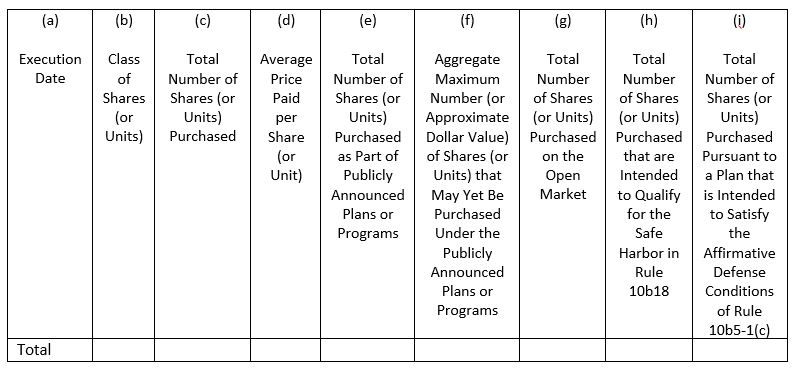

Tabular Disclosure of Daily Activity

The final rule will require tabular disclosure of an issuers’ repurchase activity, aggregated on a daily basis, and reported on an issuers’ Form 10-Q and 10-K, Form N-CSR, or Form F-SR. The final rule will also eliminate the previous requirements in Regulation S-K, Form 20-F, and Form N-CSR that required monthly repurchase data to be disclosed in the periodic reports.

For each day, an issuer will be required to include a table with its repurchase activity in the form as below:

Corporate issuers who file domestic forms will be required to file the information quarterly on their Form 10-Q and annually on Form 10-K. Listed Closed-End Funds will be required to file the information on their annual and semi-annual reports on their Form N-CSR. Foreign private issuers will disclose the information quarterly in the new Form F-SR that will be due 45 days after the end of the foreign private issuers’ fiscal quarter.

Narrative Disclosures

Beyond the tabular disclosure of an issuers’ repurchase activity, the final rule expands the previous requirements’ narrative disclosures. Issuers subject to the final rule will now also require disclosure of:

(1) the objectives or rationales for its share repurchases and the process or criteria used to determine the amount of repurchases and

(2) any policies and procedures relating to purchases and sales of the issuer’s securities during a repurchase program by its officers and directors, including any restriction on such transactions.

These narrative disclosures are in addition to what is already required from issuers, including the disclosure of shares (or units) purchased other than through a publicly announced plan or program and the nature of the transaction, as well as certain information for publicly announced repurchase plans or programs.

Checkbox for Section 16 Officers and Directors

The final rule requires that an issuer include a checkbox above the tabular disclosure which indicates whether Section 16(a) officers and directors purchased or sold securities that are subject to an issuer share repurchase plan before or after the announcement of the repurchase plan. This box must be checked if the triggering trades occur within four business days before or after the announcement of the repurchase plan. For foreign private issuers, the checkbox requirement applies to any director and member of senior management who would be identified pursuant to Item 1 of Form 20-F.

Insider Trading and Rule 10b5-1

In December 2022, the SEC adopted amendments to Rule 10b5-1 to require new disclosures to enhance visibility regarding insider trading. The Rule 10b5-1 amendments included disclosure requirements regarding the adoption, modification, and termination of Rule 10b5-1 plans. Now, in the final rule, the SEC has adopted new Item 408(d) of Regulation S-K to allow investors to better observe the use of Rule 10b5-1 plans.

The final rule requires quarterly disclosure for an issuer’s adoption or termination of Rule 10b5-1 trading arrangements. Issuers will require disclosure of, during the most recently completed fiscal quarter, issuer adoption or termination of a contract, instruction, or written plan to purchase or sell its securities, which is intended to satisfy the affirmative defense conditions of Rule 10b5-1 and also a description of any material terms of the contract, instruction, or written plan.

Inline XBRL

Consistent with other SEC rules, issuers must tag the information disclosed pursuant to the final rule with Inline XBRL.

If you still have questions about the SEC’s final rule on share repurchase disclosures, please reach out to David Lavan, Alex Albers or your Dinsmore compliance representative.