Size Matters: SEC Helps Middle Market Companies

September 19, 2018 – Legal AlertsFinTech, Business Services and Pharma Product Companies Expected to Benefit

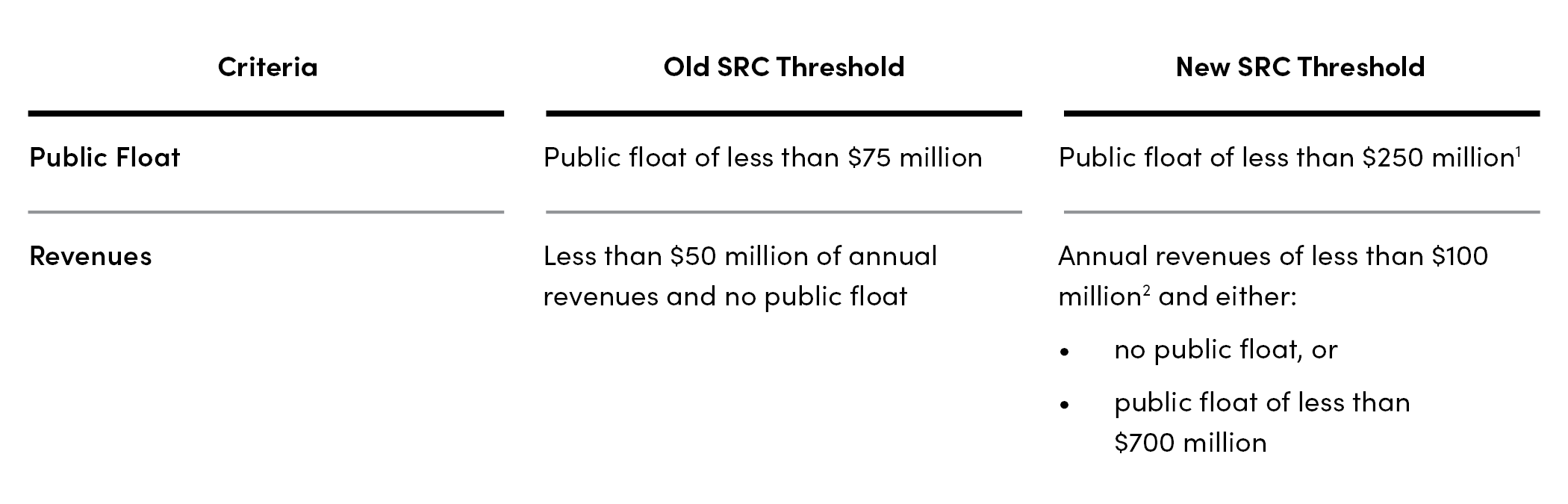

Recently, the Securities and Exchange Commission adopted amendments to the smaller reporting company definition to increase the thresholds for eligibility and to adopt certain other changes. Under the new SRC definition, a company with less than $250 million of public float will be eligible to provide scaled disclosures. Companies with less than $100 million in annual revenues and either no public float or a public float less than $700 million will also be eligible to provide scaled disclosures. The SEC made no revisions to the actual scaled disclosure requirements available to SRCs. The revised SRC qualification rules are effective on September 10, 2018.

The SEC has historically recognized that a single size regulatory structure for public companies does not fit all. As a result, the SEC has adopted a number of rules that, in effect, have created a graduated disclosure regime for public companies from accelerated filing requirements for larger companies to reduced disclosure requirements for Emerging Growth Companies and SRCs. The SEC expects about 1,000 companies to qualify as an SRC as a result of the revised definition and to possibly take advantage of the new rule changes.

Are you a company that is eligible to take advantage of these new changes? Even if you are eligible, should you take advantage of these new changes? What occurs if you are initially not eligible but become eligible at a later time? And what is “scaled disclosure” and which of the many SEC rules does an SRC not have to comply with? In this article, we explore these and other related topics.

What is an SRC and what did the SEC change?

The SEC’s new thresholds for determining SRC status are based on (a) having a public float of $250 million or (b) a revenue test which also includes a public float component. Once a company determines that it qualifies as an SRC, it will remain an SRC until it exceeds the initial qualification thresholds. The new rules provide three paths to becoming an SRC — one for companies doing an initial public offering, and two for existing public companies — a transition rule this year using the IPO thresholds and, for companies that failed to meet the initial thresholds, the ability to become an SRC if it meets lower revenue and market cap thresholds.

Initial Qualification

The following table summarizes the amendments to the SRC thresholds for companies making an initial determination under the revised rules or a current SRC confirming its continued compliance. A company needs to meet only one of the two thresholds.

What if you are already a public company?

Transition Rule for Existing Public Companies

For the first fiscal year after September 10, 2018, existing public companies may qualify by applying the new initial qualification thresholds rather than the lower subsequent qualification thresholds. A calendar year company will test its status based on its revenues for the year ended December 31, 2017, and its public float as of June 29, 2018.

What occurs if you are initially not eligible but become eligible at a later time?

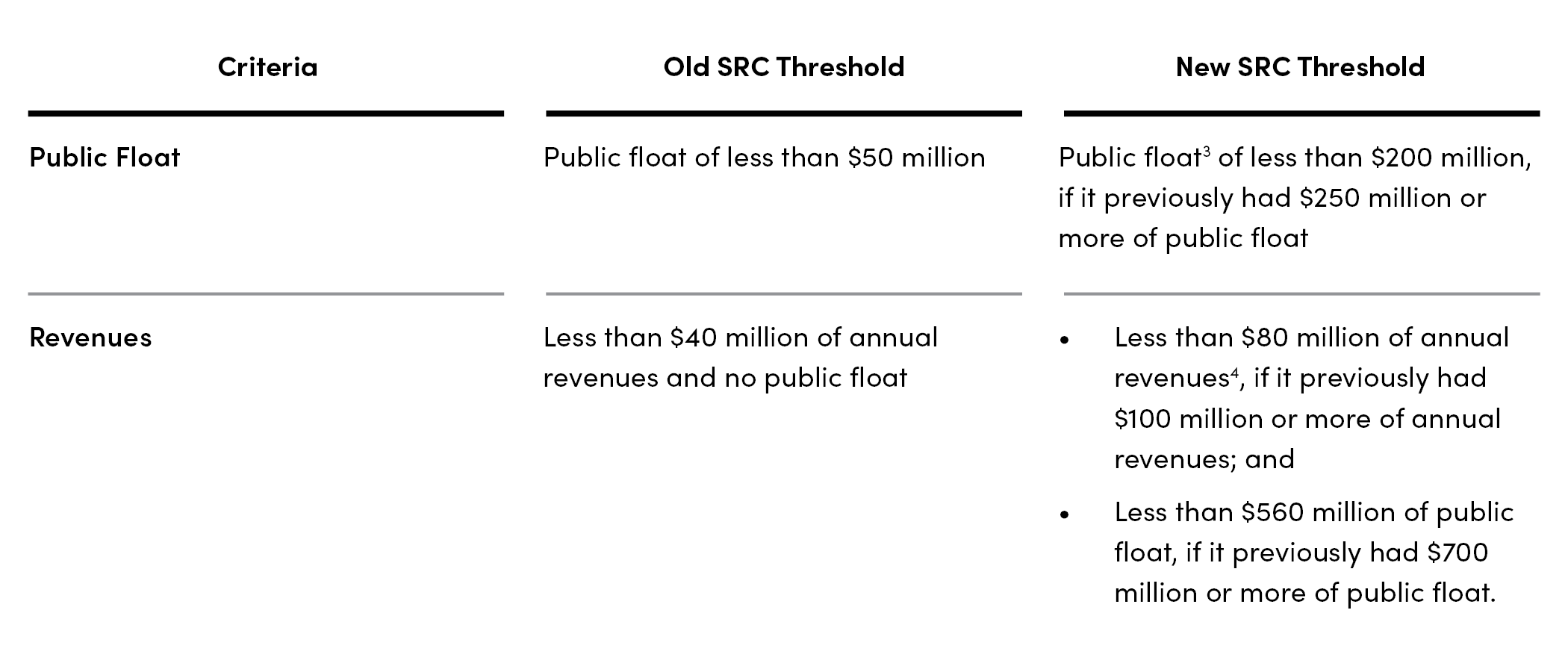

Subsequent Qualification

If a public company determines it does not qualify for SRC status because it exceeded one or more of the foregoing thresholds, it will remain unqualified, unless when making a subsequent annual determination it meets one or more lower qualification thresholds. The subsequent qualification thresholds, set forth in the table below, are set at 80 percent of the initial qualification thresholds. Stated differently, this test is for issuers that are currently required to file reports under Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended.

The SEC provided the following example in its guidance:

Example: A company has a December 31 fiscal year end. Its public float as of June 28, 2019, was $710 million and its annual revenues for the fiscal year ended December 31, 2018, were $90 million. It therefore does not qualify as an SRC. At the next determination date (June 30, 2020), it will remain unqualified for SRC status unless it determines that its public float as of June 30, 2020, was less than $560 million and its annual revenues for the fiscal year ended December 31, 2019, remained less than $100 million.

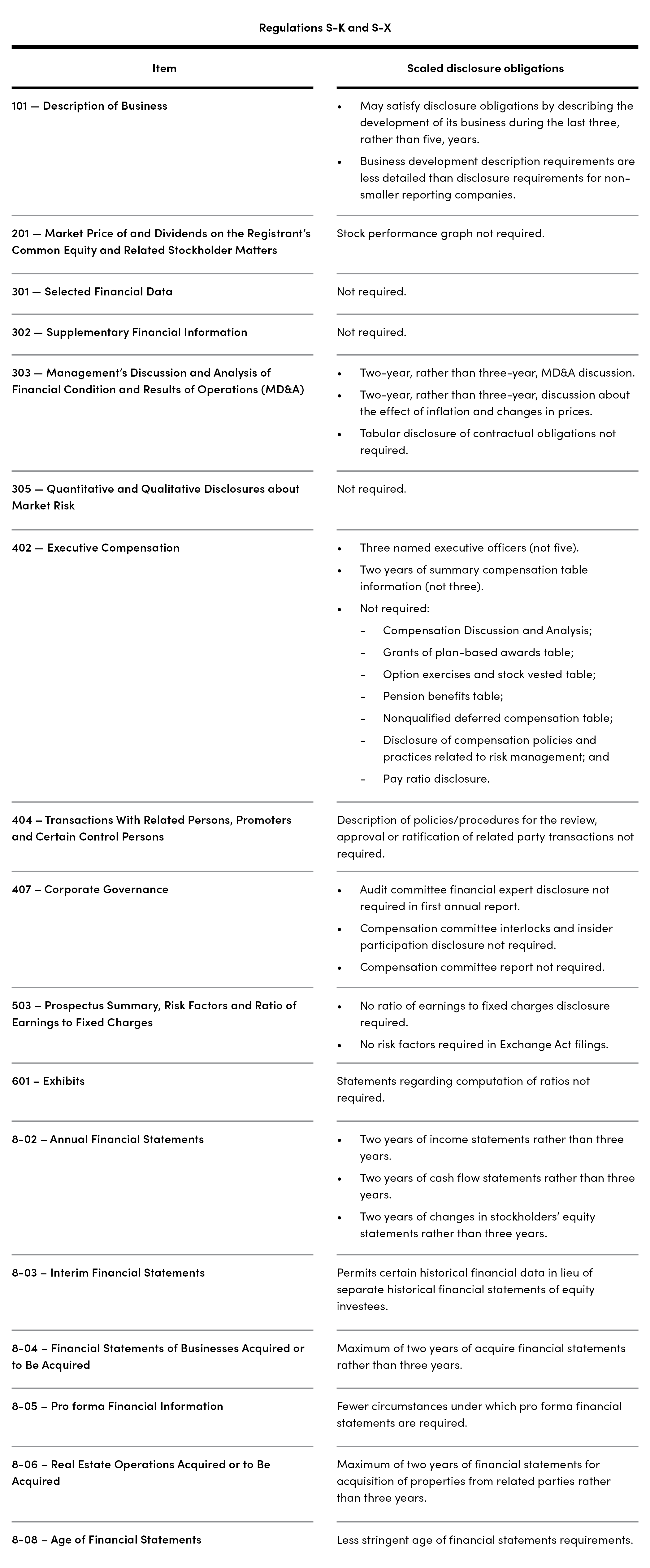

What is “scaled disclosure” and which of the many SEC rules does an SRC not have to comply with?

An advantage of being an SRC is that such a company can comply with certain SEC rules and regulations that are less onerous. An SRC can pick and choose between scaled or non-scaled financial and non-financial item requirements on an item-by-item basis. For a side-by-side comparison of the SRC rules and rules applicable to non-SRCs, please see the attached Appendix A.

There are specific rules regarding entering and exiting the SRC reporting regime and most companies solicit expert advice regarding compliance with such rules. A larger reporting company that determines it qualifies to be an SRC as of the last business day of its most recently completed second fiscal quarter is permitted to file as an SRC in its quarterly report for such quarter. When a company no longer qualifies as an SRC as of the end of its most recently completed second fiscal quarter, it can continue to use the scaled disclosure accommodations available to SRCs through subsequent annual report on Form 10-K. The filing deadline for the Form 10-K will be based on the company’s filing status as of the end of the fiscal year covered by the Form 10-K.

Is it always better to be an SRC?

No. SRCs are subject to additional disclosure requirements with respect to transactions with related persons, promoters and certain control persons under Regulation S-K, Item 404. However, rather than the $120,000 threshold under Item 404, SRCs are subject to a threshold that is the lesser of $120,000 or 1 percent of total assets. The resulting disclosure must address the two preceding years. In addition, SRCs are also subject to additional Item 404 disclosure requirements regarding any underwriting compensation received by their corporate parent or any related persons. This Item 404 disclosure is mandatory for all companies qualifying as an SRC, regardless of whether it elects to take advantage of the scaled disclosure accommodations for SRCs.

Do SRCs need to file auditors’ attestation reports under Section 404(b) of the Sarbanes-Oxley Act I?

Sometimes. Only non-accelerated filers and emerging growth companies are exempt from the requirement to provide an auditors’ attestation report. As a result, it is possible that a company could qualify as an SRC and be eligible to provide scaled disclosure but at the same time also qualify as an accelerated filer and be required to provide an auditors’ attestation report. Note that SEC Chairman Jay Clayton has directed the SEC Staff to exempt some companies from the SOX 404(b) auditors’ attestation report.

Pointers:

- Companies that have completed an initial public offering in the past five years will soon lose their Emerging Growth Company eligibility due to the passage of time. Qualifying for SRC status will enable them to take advantage of the scaled disclosure regime.

- There will be a greater number of companies that qualify as both an SRC and an accelerated filer and will be required to check both boxes on the cover page.

- Companies should keep in mind the status of their competitors and whether qualifying as an SRC may negatively impact market perception of the company. Given the complexity of the federal securities laws, it is prudent to consider some of these issues sufficiently in advance. In addition, companies should keep in mind their long-term capital raising plans as the market practices develop.

- Given the rampant use of stock buy-backs, a company could plan its entry into the SRC regime based on its revenues and public float.

- It is possible for a company not to have a public float. This could occur if a company does not have any public common equity outstanding or no market price for its common equity exists.

- If you are a tech company with no revenue, it is highly likely that you will qualify as an SRC.

1A registrant that qualifies as an SRC under the public float threshold does not need to meet the revenue threshold. The public float determination is made as of a date within 30 days of the date of the filing of the registration statement and computed by multiplying the aggregate worldwide number of shares of its voting and non-voting common equity held by non-affiliates before the registration plus, in the case of a Securities Act registration statement, the number of shares of its voting and non-voting common equity included in the registration statement by the estimated public offering price of the shares.

2 The annual revenues are as of the most recently completed fiscal year for which audited financial statements are available.

3 The public float determinations is measured as of the last business day of the issuer’s most recently completed second fiscal quarter and computed by multiplying the aggregate worldwide number of shares of its voting and non-voting common equity held by non-affiliates by the price at which the common equity was last sold, or at the average of the bid and asked price of common equity, in the principal market for the common equity. For a calendar-year company, this determination is as of June 29, 2018.

4 The annual revenues are as of the most recently completed fiscal year for which audited financial statements are available.